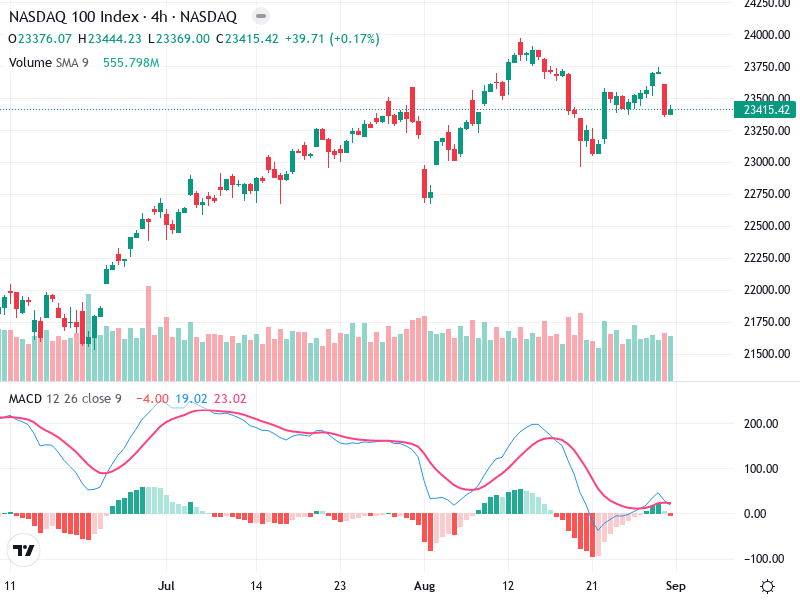

The NASDAQ 100 Index 4-hour chart currently exhibits a bullish trend with consistent upwards movement.

Despite minor pullbacks, the overall market structure remains positive with potential for further growth.

The overall trend is bullish, indicated by higher highs and higher lows.

No reversal patterns like doji or hammer are visible, though small red candles indicate minor pullbacks.

Price consolidation around the 23,400 level follows a pullback from a high near 23,750.

The MACD line is very close to the Signal line, suggesting indecision.

The histogram is ticking downwards, hinting at reduced bullish momentum.

No clear divergences are currently noted, but weakening momentum is possible.

Trading volume remains stable with no significant spikes.

A decrease in volume during pullbacks suggests weaker bearish pressure.

No unusual spikes indicate institutional activity at this time.

Resistance is noted around 23,750, recently acting as a ceiling for price action.

Support is visible near the 23,250 level, maintaining through the latest pullback.

Breaching these levels will be crucial for future price direction, with potential for a continued bullish trend above resistance.

Considering the bullish trend, a hold strategy might be wise amid MACD weakness.

Monitor for a MACD bearish crossover and price action near 23,750 and 23,250 for breakout signals.

Risks include a confirmed bearish crossover with increased volume potentially signaling reversal.

Welcome to our trading site! We offer the best, most affordable products and services around. Shop now and start finding great deals!

Subscribe to our newsletter to stay informed about our latest products, services, and promotions.

Secured By SSL. Copyright © Seekapa. All rights reserved. 2024

Company Information: This website (www.seekapa.com.com/) is operated by Bluepine Ltd, a Seychelles investment firm, authorised and regulated by the Financial Services Authority of Seychelles with license number SD183. Bluepine Ltd is located at Suite 205, 2nd Floor, Waterside Property Limited, Eden Island, Seychelles

Risk warning: Contracts for difference (‘CFDs’) is a complex financial product, with speculative character, the trading of which involves significant risks of loss of capital. Trading CFDs, which is a marginal product, may result in the loss of your entire balance. Remember that leverage in CFDs can work both to your advantage and disadvantage. CFDs traders do not own, or have any rights to, the underlying assets. Trading CFDs is not appropriate for all investors. Past performance does not constitute a reliable indicator of future results. Future forecasts do not constitute a reliable indicator of future performance. Before deciding to trade, you should carefully consider your investment objectives, level of experience and risk tolerance. You should not deposit more than you are prepared to lose. Please ensure you fully understand the risk associated with the product envisaged and seek independent advice, if necessary. Please read our Risk Disclosure document.

Regional Restrictions: Bluepine Ltd does not offer services within the European Economic Area as well as in certain other jurisdictions such as the USA, British Columbia, Canada and some other regions.

Bluepine Ltd does not issue advice, recommendations or opinions in relation to acquiring, holding or disposing of any financial product. Bluepine Ltd is not a financial adviser.

Secured By SSL. Copyright © Seekapa. All rights reserved. 2024

Company Information: This website (www.seekapa.com.com/) is operated by Bluepine Ltd, a Seychelles investment firm, authorised and regulated by the Financial Services Authority of Seychelles with license number SD183. Bluepine Ltd is located at Suite 205, 2nd Floor, Waterside Property Limited, Eden Island, Seychelles

Risk warning: Contracts for difference (‘CFDs’) is a complex financial product, with speculative character, the trading of which involves significant risks of loss of capital. Trading CFDs, which is a marginal product, may result in the loss of your entire balance. Remember that leverage in CFDs can work both to your advantage and disadvantage. CFDs traders do not own, or have any rights to, the underlying assets. Trading CFDs is not appropriate for all investors. Past performance does not constitute a reliable indicator of future results. Future forecasts do not constitute a reliable indicator of future performance. Before deciding to trade, you should carefully consider your investment objectives, level of experience and risk tolerance. You should not deposit more than you are prepared to lose. Please ensure you fully understand the risk associated with the product envisaged and seek independent advice, if necessary. Please read our Risk Disclosure document.

Regional Restrictions: Bluepine Ltd does not offer services within the European Economic Area as well as in certain other jurisdictions such as the USA, British Columbia, Canada and some other regions.

Bluepine Ltd does not issue advice, recommendations or opinions in relation to acquiring, holding or disposing of any financial product. Bluepine Ltd is not a financial adviser.