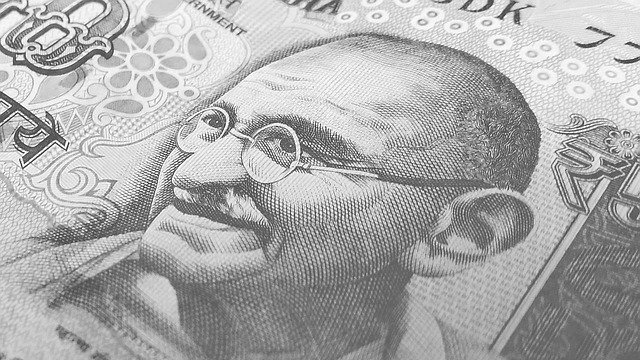

The Indian Rupee (INR) is experiencing a notable gain during the early hours of Wednesday in the Asian markets, attributed to a decrease in crude oil prices alongside strengthening Asian currencies. Additionally, it is anticipated that the Reserve Bank of India (RBI) may intervene in the foreign exchange market, which provides further support for the rupee. However, the INR’s rise may be moderated by continued outflows from domestic equities and renewed demand for the US Dollar (USD).

Market participants are keenly awaiting the RBI’s decision on interest rates, expected to be announced later on Wednesday. Analysts predict that the RBI will maintain its current policy rates, adopting a more neutral approach in response to inflation concerns. At the same time, attention is also drawn to the minutes of the recent Federal Reserve meeting set to be released, which could influence market sentiment.

Recent insights from analysts indicate that surging oil prices alongside the strengthening dollar have increased inflationary pressures in India. This situation has led the RBI to engage in significant foreign exchange interventions to stabilize the rupee. Meanwhile, as of late September, India’s foreign exchange reserves have reached an impressive $704.89 billion, marking a growth of $12.5 billion.

In the US, Federal Reserve officials have highlighted a shifting perspective on employment and inflation risks, suggesting a growing likelihood of interest rate cuts in the coming months. Market sentiments have adjusted accordingly, with expectations for a nearly 87% probability of a 25 basis point cut by the Fed in November, an increase compared to the previous week.

From a technical perspective, the outlook for the USD/INR remains positive. The pair is trading above a descending trend line and the crucial 100-day Exponential Moving Average (EMA). Key resistance is noted around the psychological level of 84.00, with higher barriers at 84.15 and 84.50. Conversely, initial support is identified at 83.90, with the potential for further declines towards 83.67 if selling pressures continue.